Session Fib Fan: Complete Setup Guide

Session Fib Fan takes the guesswork out of Fibonacci analysis by automatically plotting fan levels from the prior session's price extremes. At each session boundary, it identifies the key price points and draws a directional fan with multiple Fibonacci ratio lines projected forward into the current session. These diagonal levels act as dynamic support and resistance that traditional horizontal levels miss.

What It Does

Unlike manual Fibonacci tools that require you to pick anchor points, Session Fib Fan does it automatically using mathematically consistent session boundaries. The fan direction flips based on the session's price structure, always matching the prevailing context. This makes it ideal for intraday traders who want precise diagonal S/R without the subjectivity of manual drawing.

Key Features

Automatic Fan Plotting

Draws multiple Fibonacci fan lines from the previous session's extremes automatically -no manual anchoring or drawing required.

Two Coordinate Modes

Choose between Highest-Lowest or Open-Close as the anchor points for the fan, adapting to your preferred analysis style.

Directional Awareness

The fan direction flips automatically depending on the session's price structure, always matching the prevailing session context.

Configurable Session Timeframe

Set the session timeframe to Daily, Weekly, or any higher timeframe to draw fans based on different session boundaries.

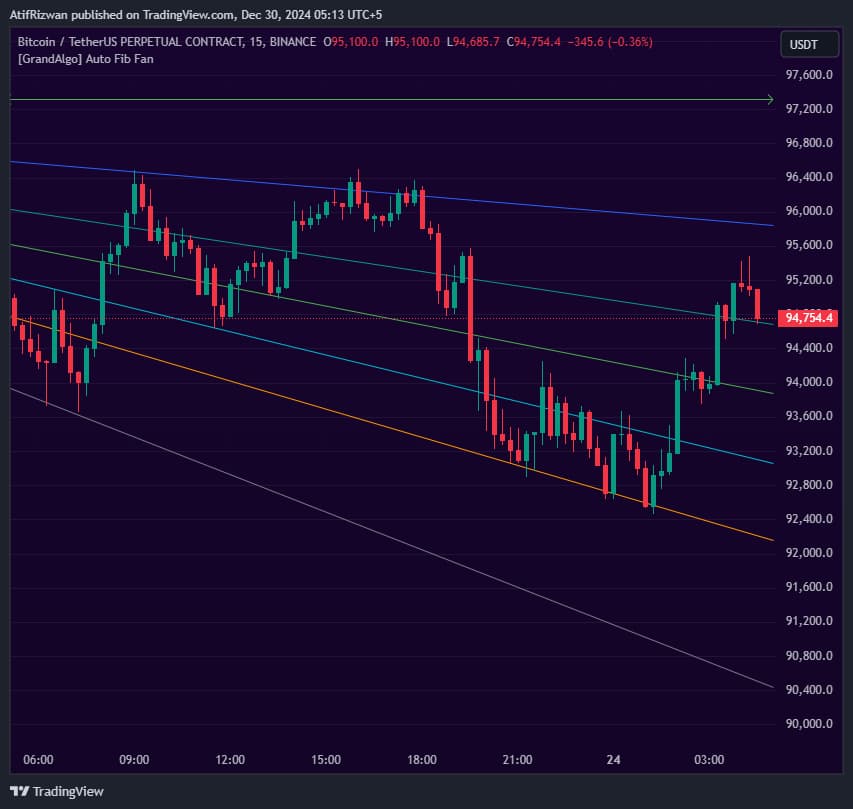

In Action

Session Fib Fan applied across different markets.

Settings & Parameters

Key settings you can configure in TradingView.

| Parameter | Type | Default | Description |

|---|---|---|---|

| Session | timeframe | D | Sets the timeframe for the session on which the fan is calculated. Use Daily for intraday, Weekly for swing trading. |

| Fan Co-Ordinates | string | Highest-Lowest | Determines the anchor points for the fan: either Highest-Lowest or Open-Close of the selected session. |

| Show Session Separator | bool | false | Displays a vertical line at each session boundary for visual reference. |

| Show Historical | bool | false | Shows fans from previous sessions instead of only the current one. |

How to Use It

Set Your Session Timeframe

Choose the session timeframe that matches your trading style. Daily works best for intraday scalping and day trading. Weekly is better for swing traders looking at broader price corridors.

Choose Your Coordinate Mode

Use Highest-Lowest for the widest fan range based on price extremes. Switch to Open-Close if you prefer fans anchored to session opening and closing prices for a tighter analysis.

Identify Fan Level Reactions

Watch for price bouncing off individual fan lines during the current session. These diagonal levels act as dynamic support when price approaches from above and resistance when approached from below.

Combine with Horizontal Levels

Fan lines are most powerful when they intersect with horizontal support/resistance or other indicator zones. Look for confluence points where a fan line meets a key price level.

Best Practices

Use on Intraday Timeframes

The indicator shines on 1-minute to 1-hour charts where intraday session dynamics are most relevant. Higher timeframe charts may not benefit from session-level fan analysis.

Look for Fan Line Clusters

When multiple fan lines from different Fibonacci ratios converge near the same price, that area becomes a high-probability reaction zone.

Respect the Fan Direction

The fan direction indicates the session's bias. Trading with the fan direction tends to produce higher-probability setups than counter-trend entries.

Combine with Volume Analysis

Fan level reactions are more significant when accompanied by increased volume, confirming institutional participation at those diagonal levels.

Related Indicators

Related Articles

Ready to Start Trading?

Get access to Session Fib Fan alongside all 18 premium indicators.