CRT with Key Levels: Complete Setup Guide

CRT with Key Levels identifies Candle Range Theory setups -patterns where price briefly sweeps beyond a prior candle's high or low before reversing back, trapping traders on the wrong side. The indicator filters these patterns for confluence with key institutional levels: Previous Day High/Low, Previous Week High/Low, or Fair Value Gaps.

What It Does

When a CRT pattern occurs at a key level, it draws the candle range with a midpoint level and places a directional triangle signal. The result is a precise system that catches institutional liquidity grabs at the levels that institutional traders are watching.

Key Features

Candle Range Theory Detection

Identifies candles that sweep beyond the prior candle's high or low then reverse back -the classic institutional liquidity grab pattern.

Three Key Level Modes

Filter CRT signals by Previous Day High/Low, Previous Week High/Low, or Fair Value Gaps for institutional confluence.

Range & Midpoint Plotting

Draws the CRT candle's high, low, and midpoint as horizontal levels that serve as targets and entry zones.

Directional Signals

Clear triangle markers for bullish CRTs at key lows and bearish CRTs at key highs, with built-in alert conditions.

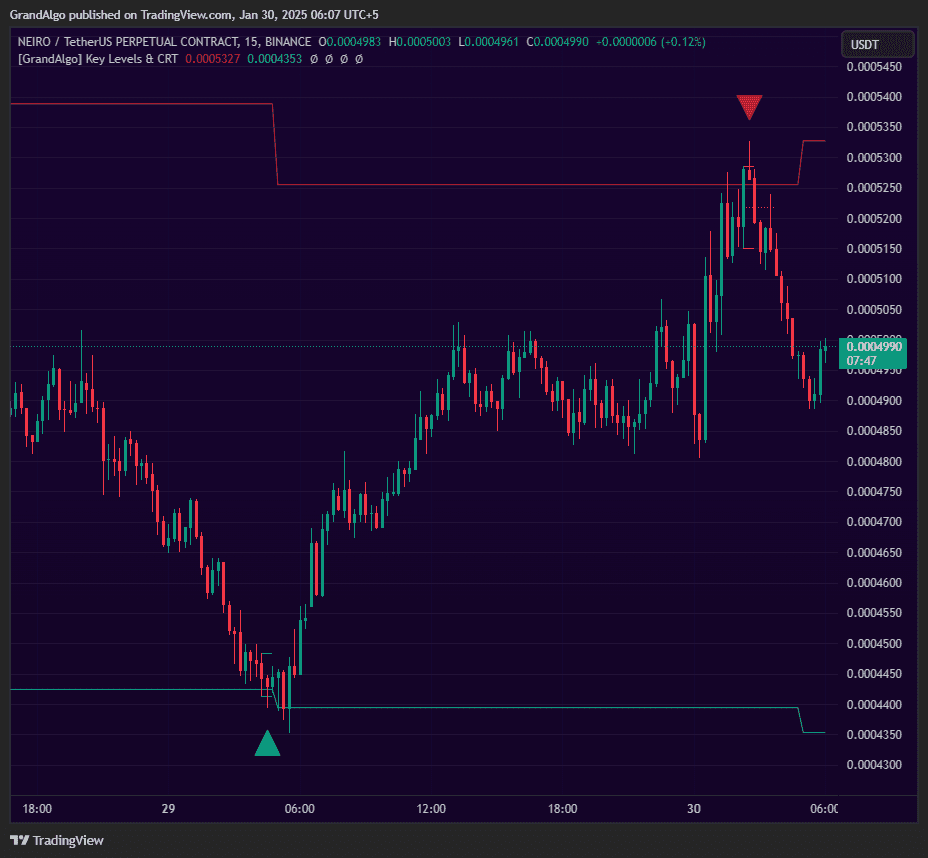

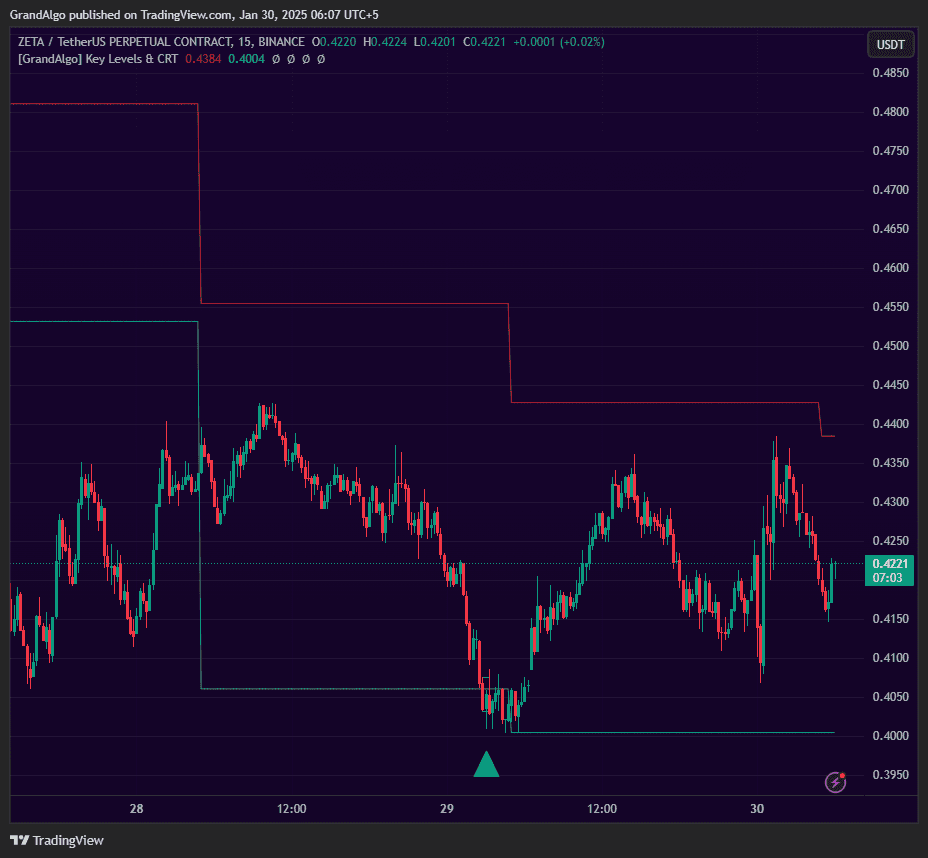

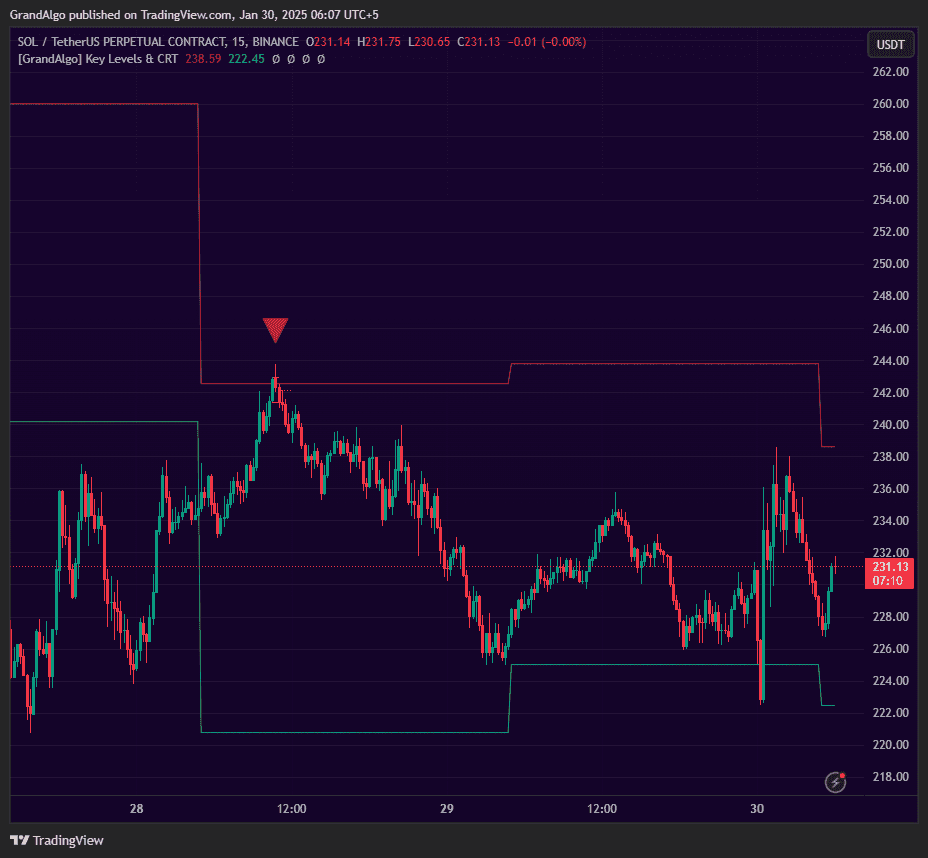

In Action

CRT with Key Levels applied across different markets.

Settings & Parameters

Key settings you can configure in TradingView.

| Parameter | Type | Default | Description |

|---|---|---|---|

| Show Only Trade Setup CRT | bool | true | When enabled, only shows CRT patterns that occur at key levels. Disable to see all CRT patterns regardless of level confluence. |

| Key Level Mode | string | PDH/PDL | Choose which institutional levels to filter by: Previous Day High/Low, Previous Week High/Low, or Fair Value Gaps. |

| Max FVG Lookback | int | 3 | When using FVG mode, how many bars back to search for a qualifying Fair Value Gap. |

How to Use It

Choose Your Key Level Mode

PDH/PDL (Previous Day High/Low) is the most popular mode for day traders. PWH/PWL works well for swing traders. FVG mode finds CRT patterns at Fair Value Gap levels for precision entries.

Identify the CRT Pattern

Look for candles that sweep beyond the prior candle's range then close back inside. This represents a failed breakout where stops were hunted before a reversal.

Use the Midpoint Level

The midpoint line drawn within the CRT range serves as an immediate target for the reversal trade. It represents the equilibrium of the CRT candle's range.

Follow the Triangle Direction

Bullish triangles appear at swept lows (long entries), bearish triangles appear at swept highs (short entries). The triangle direction is your trade direction.

Best Practices

Keep Trade Setup Filter Enabled

CRT patterns without key level confluence are less reliable. The filter ensures every signal has institutional level backing.

Best on Lower Timeframes

CRT patterns are most effective on 1-minute to 15-minute charts where the liquidity sweep and reversal happen quickly within a few candles.

Use the Range as Risk Definition

The CRT candle's full range provides a natural stop-loss placement. If price breaks beyond the sweep high/low, the pattern has failed.

Related Indicators

Ready to Start Trading?

Get access to CRT with Key Levels alongside all 18 premium indicators.