Candle Trap Zone: Complete Setup Guide

Candle Trap Zone identifies specific candles where a significant percentage of surrounding candles are trapped within that candle's high-low range. This is a sign that the market consolidated heavily at that level, creating a zone of trapped traders whose stops and limit orders create future price magnets.

What It Does

When the trapped ratio exceeds your strength threshold, a zone is drawn with Fibonacci cloud extensions projecting above and below, creating a wider influence area. Zones auto-extend when price re-enters, and smart proximity detection prevents overlapping zones. The result is a clean map of areas where the market has shown its hand through repeated consolidation.

Key Features

Trapped Candle Analysis

Analyzes how many candles are trapped within a reference candle's range -zones form only when the trapped ratio exceeds your configurable strength threshold.

Cloud Extensions

Projects semi-transparent cloud areas above and below each zone, extending the zone's visual influence area for wider context.

Proximity & Auto-Adjust

Prevents overlapping zones when new ones form near existing zones, or optionally expands the existing zone to encompass both.

Touch Detection & Alerts

Detects price touching zone boundaries and extension lines with optional visual markers and multiple alert types.

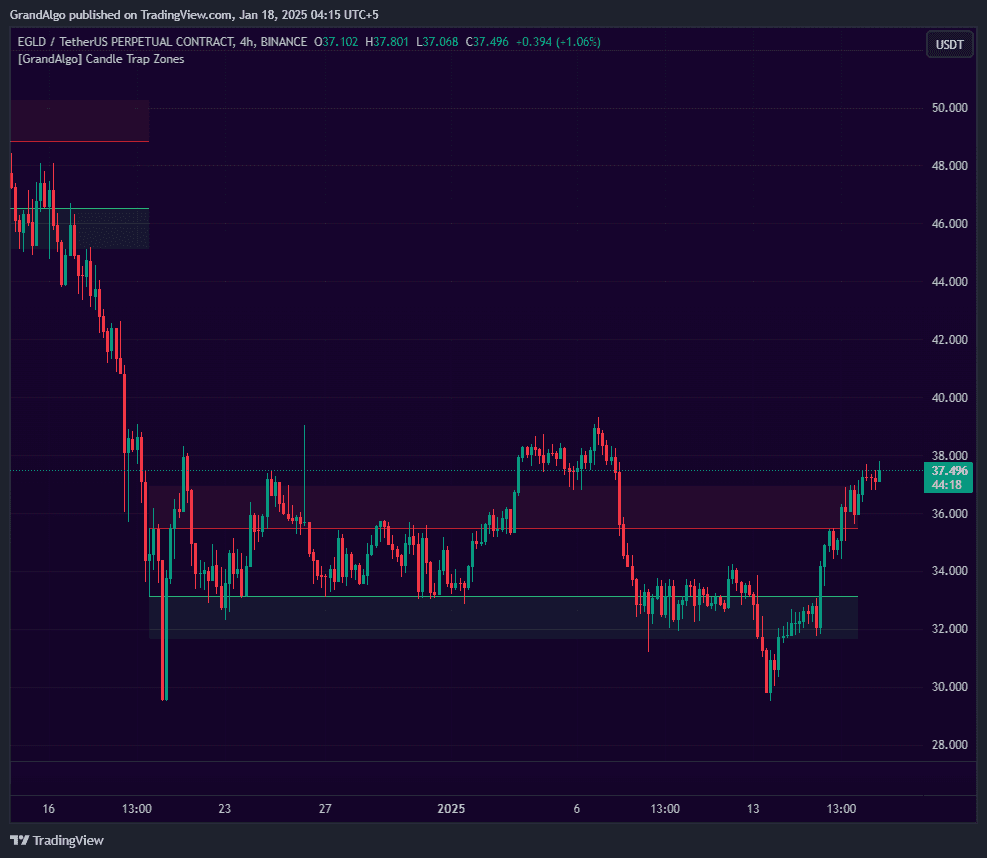

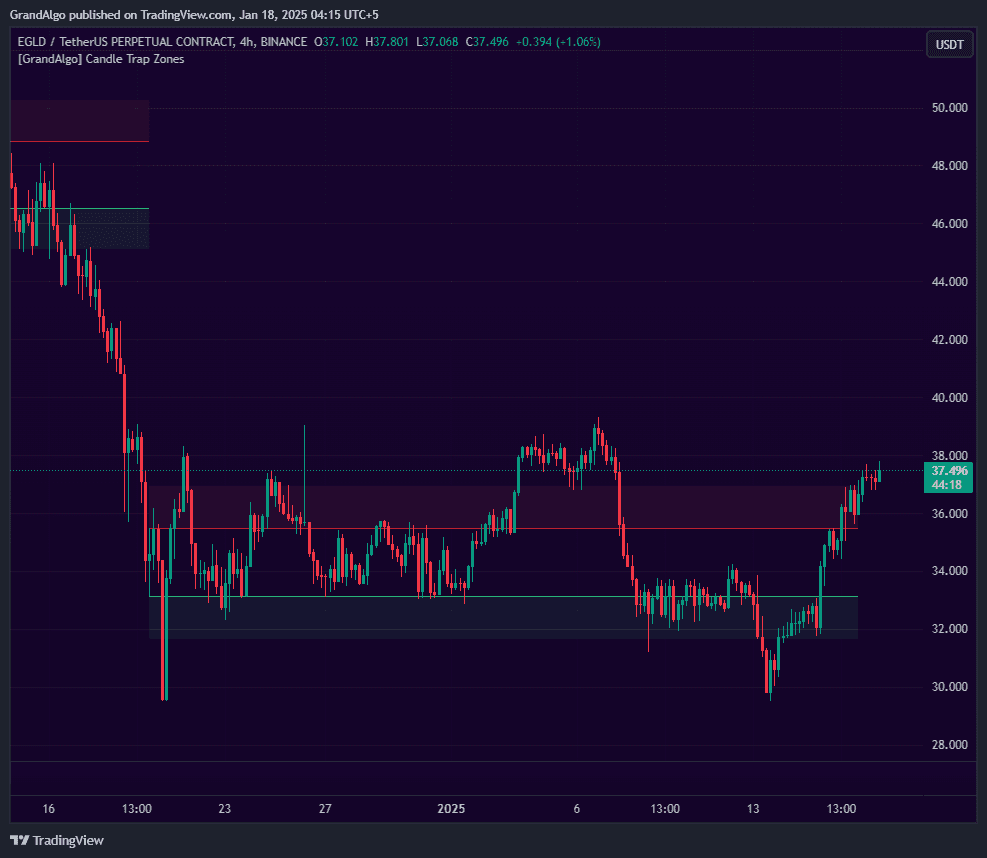

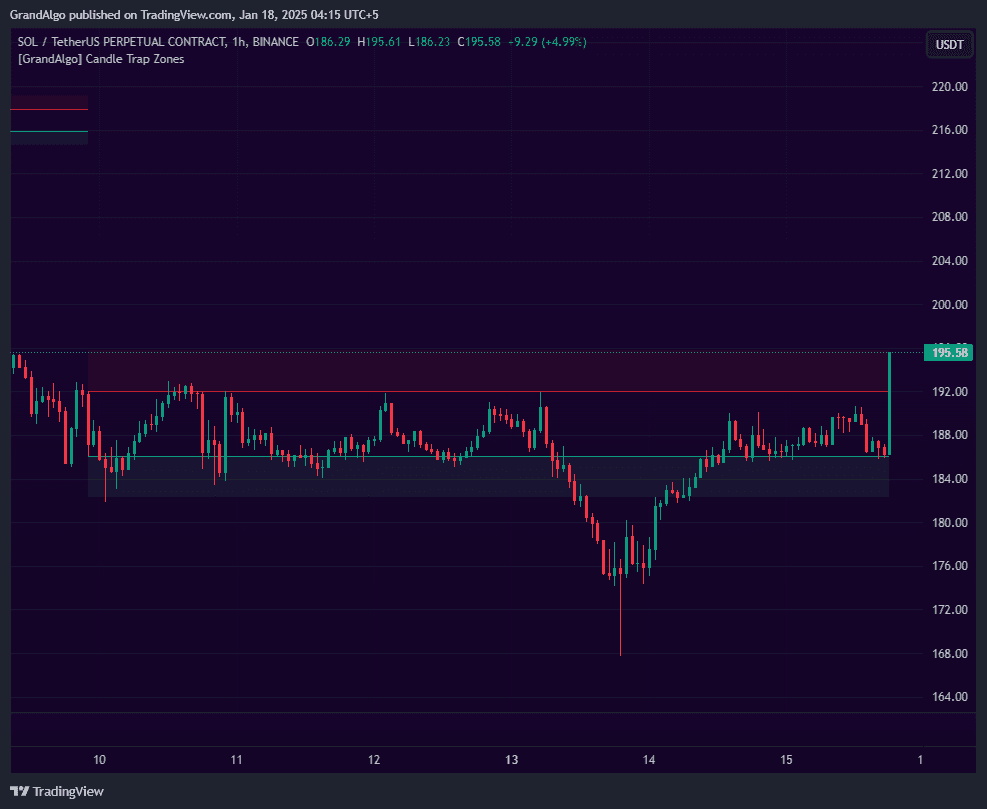

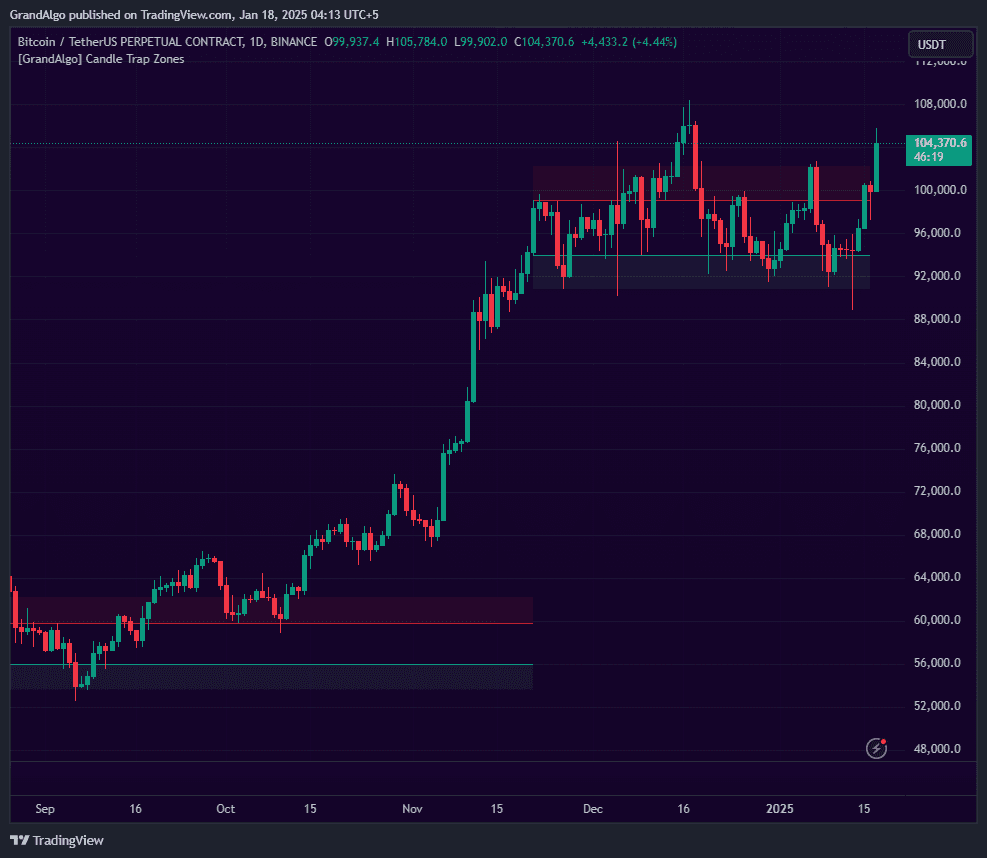

In Action

Candle Trap Zone applied across different markets.

Settings & Parameters

Key settings you can configure in TradingView.

| Parameter | Type | Default | Description |

|---|---|---|---|

| Strength | float | 0.6 | The minimum ratio of trapped candles required (0.5 to 1). Higher values produce fewer but stronger zones. |

| Draw Fib Cloud | float | 0.618 | Draws a Fibonacci cloud above and below the zone at the specified ratio, extending the zone's visual influence area. |

| Trap Detection Range | int | 30 | How many candles must be trapped within the zone to classify it as a trap zone. |

| Proximity Prevention | bool | true | Prevents new zones from forming when they overlap with existing zones, keeping the chart clean. |

| Auto Adjust Proximity | bool | false | When a new zone forms near an existing one, expands the existing zone to encompass both. |

| Extend on Re-entry | bool | true | Automatically extends the zone forward when price re-enters it after an initial reaction. |

How to Use It

Identify Fresh Trap Zones

Look for newly formed zones where price has just broken out. These represent areas where many traders are trapped and their stops create liquidity pools for potential reversals.

Watch the Cloud Extensions

The Fibonacci cloud projections above and below each zone mark the wider influence area. Price often reacts at cloud boundaries, not just at the core zone itself.

Trade Zone Retests

When price returns to a trap zone, watch for rejection signals. The trapped orders from the original consolidation create a natural reaction point that can be traded as a reversal or bounce setup.

Note Zone Breaks

When price slices cleanly through a zone, the trapped traders are liquidated and the zone loses its significance. Focus your attention on unbroken zones.

Best Practices

Start with Default Strength

The 0.6 default provides a good balance between sensitivity and quality. Only increase it if too many zones appear; decrease it if you want to catch more potential reversal areas.

Use Cloud Boundaries as Targets

The Fib cloud extensions provide natural take-profit levels when trading away from a zone, as price often stalls at these projected boundaries.

Combine with Volume

Zones that formed during high-volume periods are more significant because more traders are trapped at those levels, creating larger liquidity pools.

Pay Attention to Zone Age

Fresher zones are more actionable than older ones. As time passes, trapped traders gradually exit their positions, weakening the zone.

Related Indicators

Ready to Start Trading?

Get access to Candle Trap Zone alongside all 18 premium indicators.